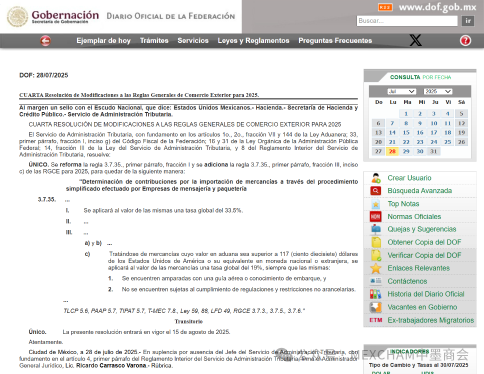

On July 28, 2025, Mexico’s Official Gazette published revisions to foreign trade rules (Fourth Resolution)

FOURTH RESOLUTION ON MODIFICATIONS TO THE GENERAL FOREIGN TRADE RULES FOR 2025

The Tax Administration Service, based on Articles 1, 2, Section VII, and 144 of the Customs Law; 33, first paragraph, Section I, subsection g) of the Federal Tax Code; 16 and 31 of the Organic Law of the Federal Public Administration; 14, Section III of the Tax Administration Service Law; and 8 of the Internal Regulations of the Tax Administration Service, resolves:

SOLE. Rule 3.7.35, first paragraph, section I, is amended, and rule 3.7.35, first paragraph, section III, subsection c) of the RGCE for 2025 is added to read as follows:

“Determination of contributions for the importation of goods through the simplified procedure carried out by courier and parcel delivery companies

3.7.35. …

I. A global rate of 33.5% shall be applied to their value.

II. …

III. …

a) and b) …

c) For goods with a customs value greater than USD 117 (one hundred seventeen USD) or its equivalent in national or foreign currency, a global rate of 19% shall be applied to the value of the goods, provided that:

1. They are covered by an air waybill or bill of lading

2. They are not subject to compliance with non-tariff regulations and restrictions.

For more details check the official complete Decree in this link:

https://dof.gob.mx/nota_detalle.php?codigo=5763997&fecha=28/07/2025#gsc.tab=0

MEXCHAM continues building bridges between Mexico and China.

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

Cámara de Comercio de México en China

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org