The Mexican automotive industry has become one of the strongest pillars of the national economy and one of the most competitive manufacturing platforms globally. With over 36 assembly plants and engine and transmission production facilities, Mexico ranks fourth worldwide in light vehicle exports and remains a strategic partner in North American value chains.

The Mexican automotive industry has become one of the strongest pillars of the national economy and one of the most competitive manufacturing platforms globally. With over 36 assembly plants and engine and transmission production facilities, Mexico ranks fourth worldwide in light vehicle exports and remains a strategic partner in North American value chains.

This success is not only due to major international automakers but also to a regional automotive cluster ecosystem that connects OEMs, Tier 1, Tier 2, and Tier 3 suppliers, engineering centers, academic institutions, business organizations, and state governments.

This collaboration model stems from the cluster theory proposed by economist Michael Porter in the 1990s, which posits that the geographical proximity of interconnected actors generates sustainable competitive advantages by sparking innovation, productivity, and entrepreneurship. In Mexico, this conceptual framework has found fertile ground in the automotive industry.

Why Are Clusters Important?

The answer lies in the benefits they generate. The physical proximity between companies, institutions, and government enables: Increased productivity due to reduced transaction costs and proximity to strategic suppliers. Fostering innovation through constant knowledge exchange, best practices, and technology transfer. Boosting entrepreneurship, as collaborative and specialized conditions create opportunities for new businesses. Enhancing regional positioning as world-class industrial hubs. Developing specialized talent through links with universities and research centers. In Mexico, these advantages are reinforced by a highly qualified workforce, top-tier logistics infrastructure, and proximity to the United States, the primary export destination. Additionally, the quality standards demanded by the North American market drive manufacturers to continuously improve.

Map of Automotive Clusters in Mexico

Currently, Mexico has 12 active automotive clusters, each with unique characteristics and leading companies driving regional development. Their locations are based on human resources, infrastructure, and logistics connectivity, facilitating integration into global value chains. Chihuahua (AutoCluster Chihuahua): A key hub in auto parts and electrical systems manufacturing, with a strong export presence to the United States. Coahuila (CIAC): An anchor region for General Motors and Stellantis, with a network of specialized Tier 1 metalworking suppliers. CIMAL (La Laguna): Focused on advanced manufacturing and auto parts, with business and academic linkages. CLAUTMET (Metropolitan): Integrates actors from the State of Mexico, Mexico City, and Hidalgo to strengthen automotive development. CLAUGTO (Guanajuato): One of the strongest clusters in the country, led by Mazda, Toyota, Honda, and GM, plus over 280 companies. CLAUT (Nuevo León): An internationally recognized success case in academia-industry collaboration, a pioneer in clustering. CLAUZ (Central Zone): In Puebla and Tlaxcala, where Volkswagen and Audi plants operate. Querétaro: Specializes in engineering, interiors, electronics, and molds. CASLP (San Luis Potosí): With BMW and GM, focused on sustainable manufacturing and supplier development. Jalisco: Aims to be a hub for electric mobility and new technologies. CLIA (Aguascalientes): An integrated vision covering automotive, aeronautics, and biomedical sectors. CLAS (Sonora): The newest, established in 2024, aimed at boosting investment, innovation, and local supply. These clusters are also integrated through the National Network of Automotive Industry Clusters (REDCAM), created in 2019 for joint projects in innovation, sustainability, and talent.

Governance and Collaboration

The Secret to Success Clusters do not operate in isolation. Their effectiveness stems from the collaborative governance of the Triple Helix model: business, academia, and government. This coordination drives supplier projects, training, investment attraction, and technology development. In many cases, clusters function as neutral forums where competitors collaborate in common areas, such as talent training or public policy design. Trust and social capital are as crucial as investments in plants or industrial parks.

The Foundations of Leadership The Mexican automotive industry would not be the same without the efforts of its clusters. Beyond attracting investments, they promote agreements, address challenges, and develop policies that benefit both businesses and communities. In an environment of global competition and technological transformation, clusters solidify as pillars supporting the growth, innovation, and sustainability of one of Mexico’s most strategic industries.

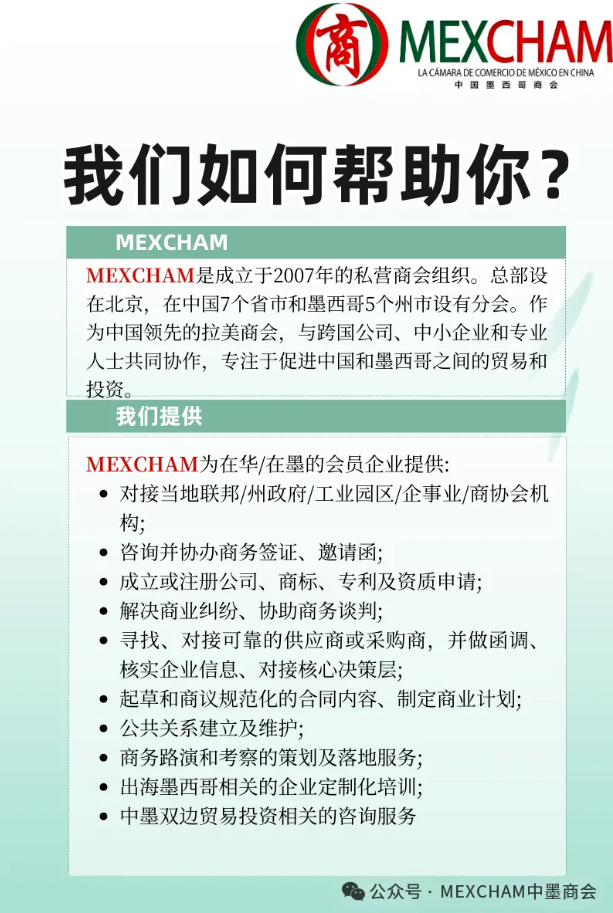

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org