“The investment plan continues as announced. Mexico remains the axis of growth for Latin America,” said Daniel Nava, Vice President, MG Motor Mexico, in an interview with El Economista. He noted that the initiative is directly supported by SAIC’s global headquarters.

Earlier this year, speculation suggested that MG might acquire Nissan’s historic CIVAC plant in Morelos, but Nava dismissed the possibility. “We are not interested in acquiring an existing facility. Our goal is to build our own project, backed by SAIC’s strength,” he explained.

MG announced the US$1.05 billion investment in November 2024, aiming to position Mexico as its regional manufacturing hub. While the company has not disclosed the plant’s exact location or construction timeline, Nava confirmed that corporate teams are already operating in Mexico to advance the plan.

The company cited Mexico’s proximity to the United States, skilled workforce, and robust export infrastructure as key factors behind the investment. “This project is strategic and demonstrates confidence in Mexico’s industrial environment,” Nava said.

Since entering Mexico in 2020, MG has become the country’s top-selling Chinese brand and ranks among the 10 largest automotive brands overall. The company sold 60,168 vehicles in 2024—its best year on record—and reached 27,597 units between January and July 2025. MG expects to close this year with 45,000–50,000 units sold, reinforcing its decision to localize production.

In April 2025, MG achieved a 4.1% market share and surpassed 200,000 cumulative units sold in Mexico since its debut. Nava emphasized that local production will lower logistics costs, improve spare parts supply, and allow the company to respond more quickly to demand in both Mexico and Latin America.

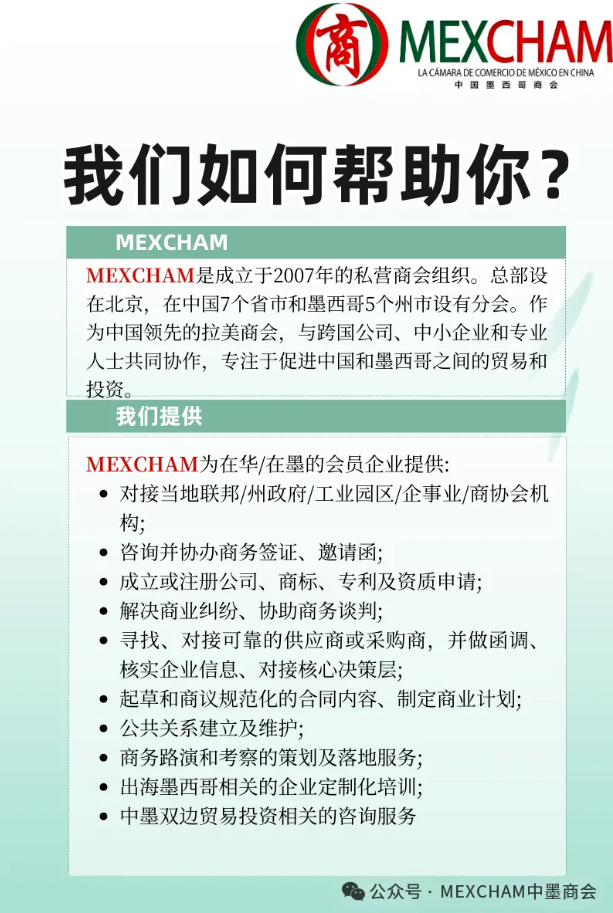

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org