Viva Aerobús accounts for 38% of domestic air travel in Mexico and Volaris 33%, so together they could claim more than 70% of the market.

Mexico’s two major low-cost airlines — Volaris and Viva Aerobús — plan to merge into a single low-cost airline group that would become the country’s largest domestic carrier.

According to their announcement Thursday, the two companies would merge under a single holding company, each maintaining its own brand and separate operations, with the aim of increasing low-cost air travel and connectivity, both domestically and internationally.

“Volaris and Viva have entered into an agreement to form a new airline group with the goal of expanding ultra-low-cost air travel for Mexicans and customers both domestically and internationally,” Volaris Executive Vice President Holger Blankenstein said in a LinkedIn post.

He added that the transaction won’t impact existing routes, contracts or agreements, and will keep fares low while increasing travel options. Passengers will also continue to purchase Volaris and Viva tickets separately.

“Customers will continue to have the same options they value today, with broader access to point-to-point travel solutions,” he said.

Meanwhile, Viva CEO Juan Carlos Zauzua said that “both airlines share a similar low-cost DNA and mindset and have always believed in making travel more accessible and possible for everyone.”

Under the terms of the agreement, the carriers will unite their holding companies in a merger of equals, leaving each company with 50% ownership. Viva shareholders will obtain newly created shares in Volaris’ holding company, while current Volaris investors will keep their stakes.

The deal is still subject to regulatory approvals and both companies expect it to be finalized in 2026, with shares remaining listed in Mexico and New York.

The new group’s board will be made up of members from both carriers and headed by Mexican magnate Roberto Alcántara, who leads the transportation group IAMSA, which owns and controls Viva.

Meanwhile, Volaris’s largest shareholder is the private equity firm Indigo Partners, which also controls the US airline Frontier and the Chilean airline JetSmart.

What the merger means for Aeroméxico

Both airlines fly exclusively Airbus aircraft and operate similar routes. They both share the same competitor in Mexico: flagship carrier Aeroméxico.

The two low-cost airlines combined hold about three-quarters of the domestic market. In 2024, Viva and Volaris together accounted for some 71% of domestic traffic (38% for Viva and 33% for Volaris), while Aeromexico hovered around one-third of the domestic market.

With the merger, the new low-cost group would become the leader in domestic flights, leaving Aeromexico as the second domestic player, with more weight on higher-value international routes.

Click here to read the original content

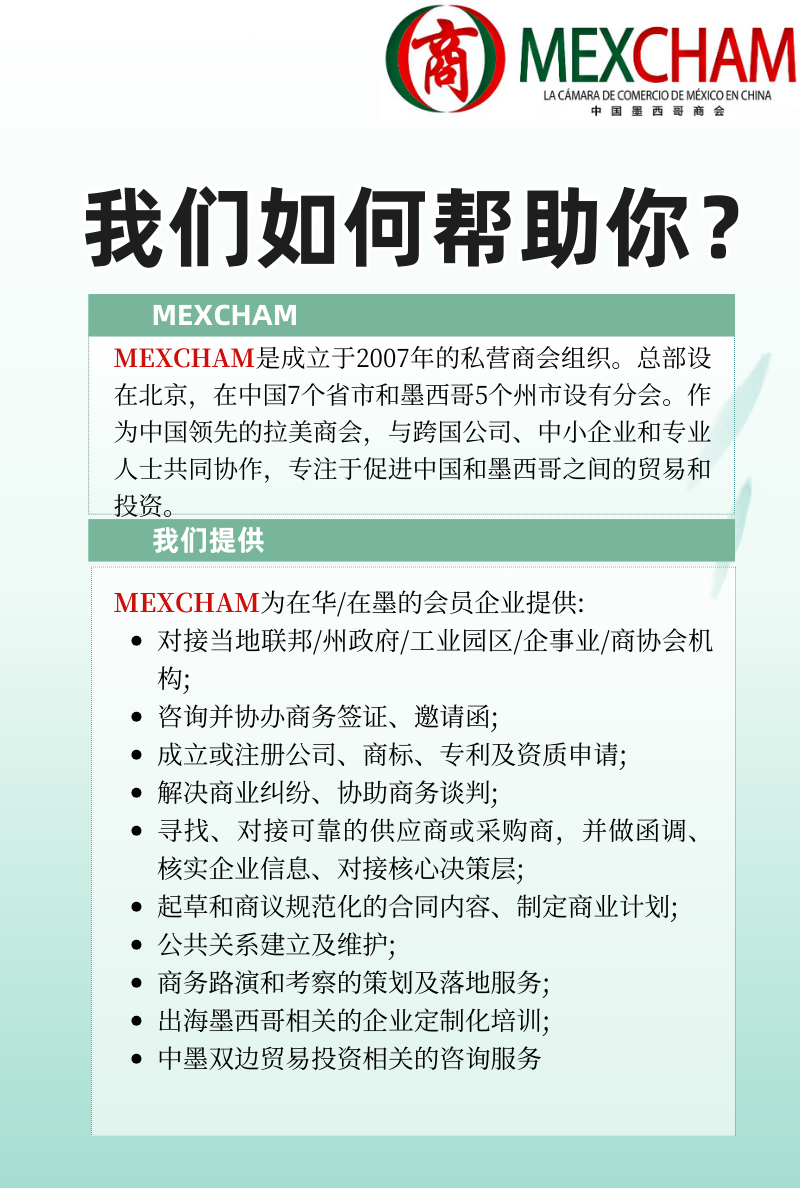

MEXCHAM continues building bridges between Mexico and China.

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

Cámara de Comercio de México en China

中国墨西哥商会

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org