AMPIP estimates that most 2026 capital will go toward expansion rather than standalone buildings. Of the projected total, 66.1% is expected to be deployed in new park developments and new industrial buildings inside parks, while 19.3% would go to upgrading existing parks and 5% to independent buildings.

In October, AMPIP stated that 103 additional industrial parks are under construction, in 52 municipalities, representing 21.5 million square meters under development, as reported by MBN. To make these projects viable, AMPIP estimates Mexico needs new installed capacity of up to 2.3 GW tied to industrial park requirements.

Despite the visibility of Central Mexico’s e-commerce-driven growth, the north continues to account for the largest share of industrial market dynamism. In 2025, the north represented 54.3% of built area, with activity across markets such as Monterrey, Juárez, Saltillo, Tijuana and Reynosa, according to figures cited by El Financiero. The Bajio-Occidente region represented 23.7%, while Mexico City and its metro area accounted for 22.1%.

AMPIP’s estimates point to a year where most capital goes into new parks and new buildings, while the sector simultaneously requires upgrades to Mexico’s energy ecosystem to keep projects on schedule and ensure the reliability expected by advanced manufacturing and large-scale logistics tenants.

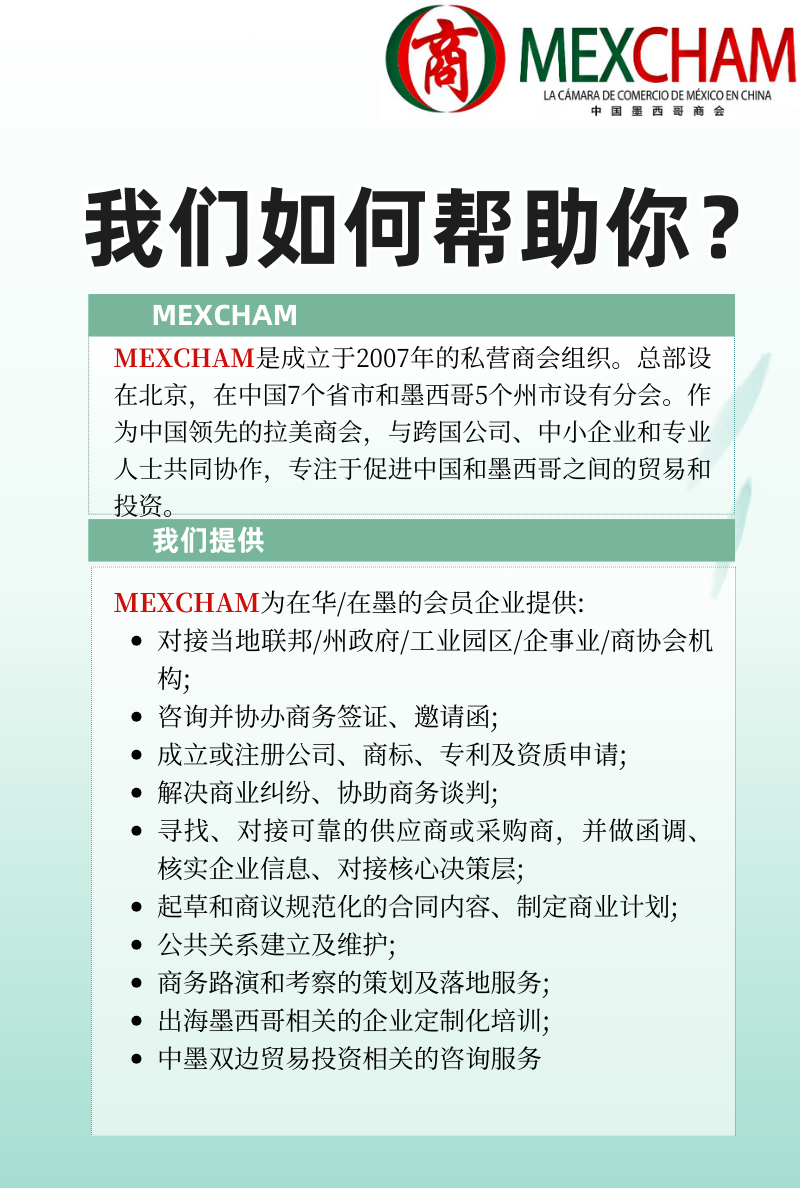

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org