The list of volume gainers is completed by Mitsubishi (2,894), KIA (2,416), Toyota (1,584), Great Wall Motor (613), BMW Group (604), Hyundai (566), and Volkswagen (524). These figures confirm the industry’s evolution favoring brands committed to compact SUVs, as well as hybrid and electric technologies.

Surge of Chinese Brands in the Mexican Automotive Market

Chinese brands recorded accelerated growth in 2025, led by MG Motor (27,597 units), JAC (14,187), Changan (9,255), Great Wall Motor (8,424), and Chirey Motor (5,559). Collectively, Chinese brands now represent 8.2% of the domestic market, surpassing countries such as France (3.4%), Spain (1.4%), and Sweden (0.4%).

In terms of annual percentage performance, Changan stands as the brand with the highest year-on-year growth in the entire Mexican market, with an increase exceeding 150% in cumulative sales, outperforming brands like Subaru, Mitsubishi, and Mazda, which also showed positive growth. This performance underscores the aggressive strategy of Chinese brands to expand in Mexico through competitive pricing, attractive design, and presence in high-demand segments.

Mexico Consolidates as a Key Market in Latin America

By brand origin, Japan dominates with a 42.0% share of the Mexican market, followed by the United States (21.1%), Germany (11.9%), and South Korea (11.1%). China, with its 8.2% share, now ranks as the fifth origin country in terms of market share, displacing traditional European countries.

This context reaffirms Mexico as one of the most dynamic and competitive markets in Latin America, with conditions conducive to brand diversification, technological innovation, and global competition. The 2025 figures reflect a structural transformation that will continue to set trends in the coming years.

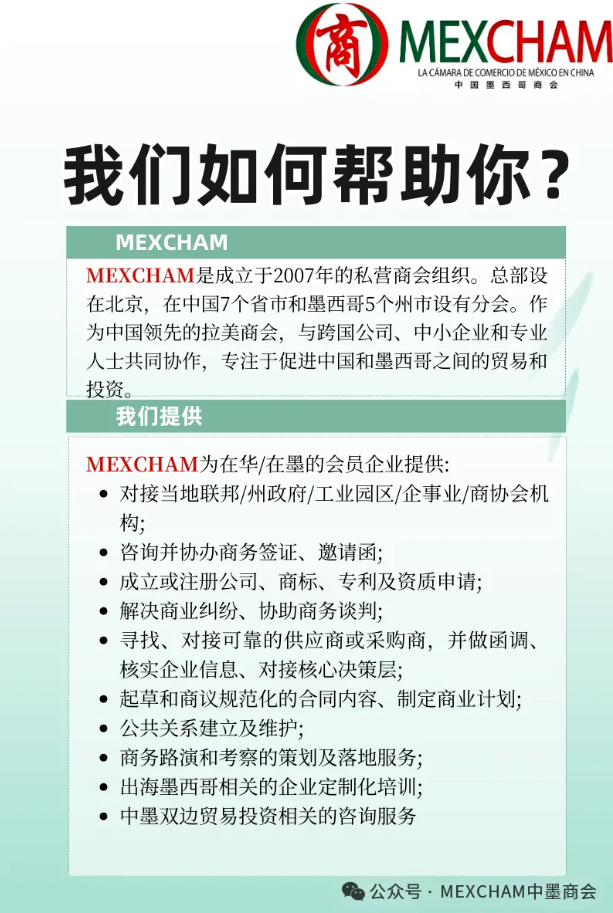

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org