The association reported that same-store sales—a key metric measuring locations open for at least one year—grew by just 3.1%. Total store sales increased 5.6%, a figure driven primarily by the opening of 1,700 new locations, rather than stronger organic demand. These figures suggest that traditional retail expansion is approaching diminishing returns, as consumers become more selective and cautious in their spending.

Pierre-Claude Blaise, CEO of the Mexican Online Sales Association (AMVO), noted that Mexico’s digital growth curve resembles China’s trajectory from roughly a decade ago. Projections indicate that by 2026, online sales will account for 17.7% of total retail sales in Mexico, approaching penetration levels seen in the United States. This momentum is underpinned by a mobile-first consumer base, with 85% of online purchases made via smartphones.

Future expansion is expected to depend on increasing purchase frequency and unlocking underpenetrated categories such as fashion. To achieve this, retailers are increasingly turning to fintech solutions—including microcredit and Buy Now, Pay Later (BNPL) models—to broaden access for underbanked consumers.

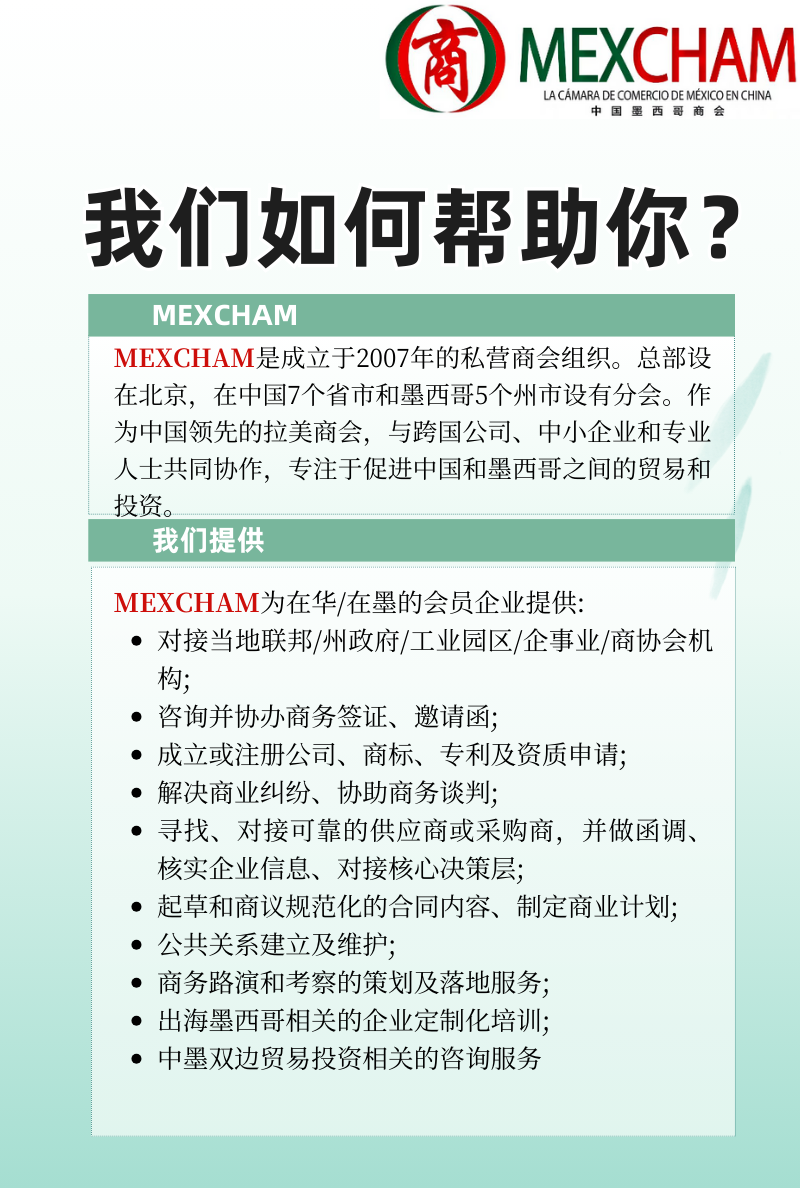

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org