Approximately 60% of all vehicles imported into Mexico now arrive from Asia, primarily through the ports of Lázaro Cárdenas and Mazatlan. Chinese manufacturers such as MG Motor, BYD, Chirey, Geely, Great Wall Motors, and Changan have significantly expanded their presence. BYD, in particular, has scaled up maritime logistics using dedicated vehicle carriers like the BYD XI’AN and BYD CHANGZHOU.

Other ports have shown mixed results. Altamira saw a 77% increase in vehicle imports during the same five-month period, receiving 6,382 units, up from 3,601 in 2024. Mazatlán experienced a 3.8% decline, unloading 73,186 units versus 75,826 the previous year, while Veracruz reported a 6.4% drop. These shifts underscore Lázaro Cárdenas’ growing importance in Mexico’s automotive logistics network.

The surge in Asian imports has put pressure on local infrastructure, especially in and around Lázaro Cárdenas. Ricardo Hernández, logistics director at Mitsubishi Motors de México, told The Logistics World, that post-pandemic volume increases pushed yard capacity to its limits. “After the pandemic, many new brands with large volumes began arriving, and almost all came through Lázaro Cárdenas,” Hernández said. This saturation led to the emergence of new logistics providers and a sharp rise in storage costs—doubling in some cases compared to pre-COVID-19 levels.

In response, Mitsubishi moved from traditional subcontracting to long-term partnerships. The company teamed with Suministros de Servicios en General y Automotrices del Puerto (SSGA) to build a 42,000-square-meter storage yard, completed in five months at a cost of MX$30–35 million. The facility meets security and certification standards (CTPAT and OEA) and is elevated six meters above the river to reduce flood risk. Mitsubishi also operates two additional yards—one with SSGA (1,500 units) and another with AMPORTS de México (2,500 units)—bringing total local capacity to 6,000 vehicles. The company plans to expand to 8,500 units by early 2026 with a new 50,000-square-meter yard, also in partnership with SSGA, at an estimated cost of MX$35–40 million.

These expansions are supported by available land near the port, particularly in ejido zones in Guerrero along the Autopista Siglo XXI and Río Balsas corridor. Hernández noted, “There is a lot of land for growth near the port, especially in Guerrero. However, challenges remain. In 2018 and 2019, before the pandemic, the industry demanded first-rate yards—paved, fenced, high-standard facilities. That level of quality is not always available today.

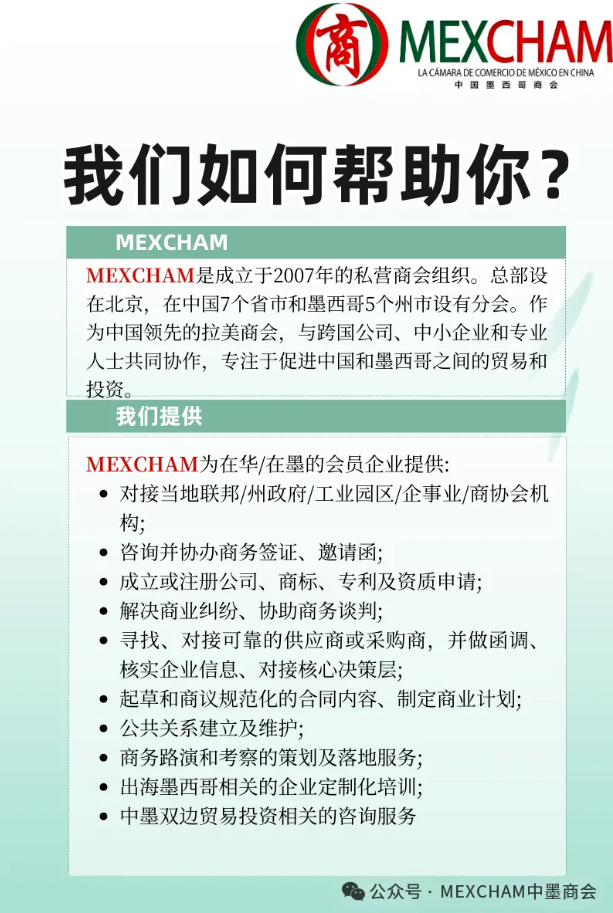

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org