The Bank of Mexico (Banxico) has significantly reduced interest rates since the beginning of the year, by 300 basis points, as the policy rate fell to 7%. The cuts have helped boost investor confidence in Mexican assets by reducing trade-related uncertainty, while much-needed cash has been injected into the economy.

Mexican stocks’ strong showing carried a reminder of the gap that often exists between the markets and the on-the-ground economy. Mexico’s GDP contracted by 0.2% in the third quarter of this year after experiencing flat growth in the second quarter. The contraction led Banxico to reduce its growth outlook to 0.3%. Meanwhile, the central bank expects Mexico’s economy to rebound gradually to 1.1% in 2026 and 2% in 2027.

The hosting of the FIFA World Cup and the anticipated review and finalization of the USMCA North American free trade agreement could help reduce trade uncertainty in 2026, Bank of America economist Carlos Capistran was reported as saying by the Benzinga news site.

However, “If weakness persists, the central bank may continue cutting rates to stimulate demand,” Capistran said.

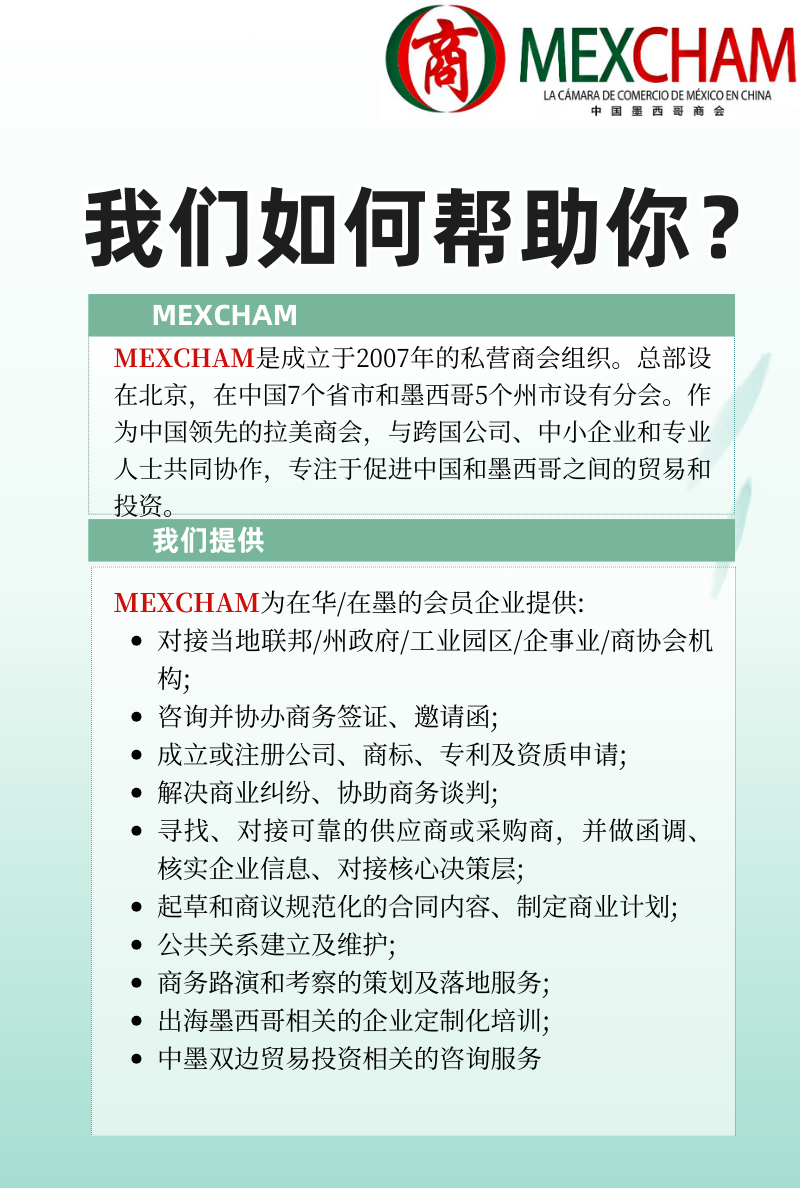

MEXCHAM continues building bridges between Mexico and China.

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

Cámara de Comercio de México en China

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org