Recent inaugurations include Yokohama in Aguascalientes (MX$464 million) and Gerresheimer in Queretaro (MX$100 million), alongside expansions from Daikin in San Luis Potosi and Hyundai MOBIS in Nuevo Leon. AIRCOM also opened a new facility in Chihuahua with an investment of MX$24 million.

The 17 projects span 11 states, including Nuevo Leon, Queretaro, which emerged as the top destinations, attracting high-value, high-tech projects. In Nuevo Leon, major announcements include Hyundai MOBIS (MX$700 million), MillerKnoll (MX$80 million), FINSA (MX$352 million) and Grupo Inmobiliario Monterrey (MX$3 billion). In Queretaro, standout projects include LG (MX$3.5 billion), Cloud HQ (MX$4.8 billion) and Gerresheimer (MX$100 million), consolidating the state’s position as a hub for manufacturing, technology and foreign direct investment (FDI).

The period’s investment activity highlights sustained private-sector confidence in Mexico’s industrial ecosystem. The balance between national and foreign capital, combined with sectoral diversity and geographic reach, reinforces the country’s role as a regional manufacturing and logistics hub with strong growth prospects through the end of 2025.

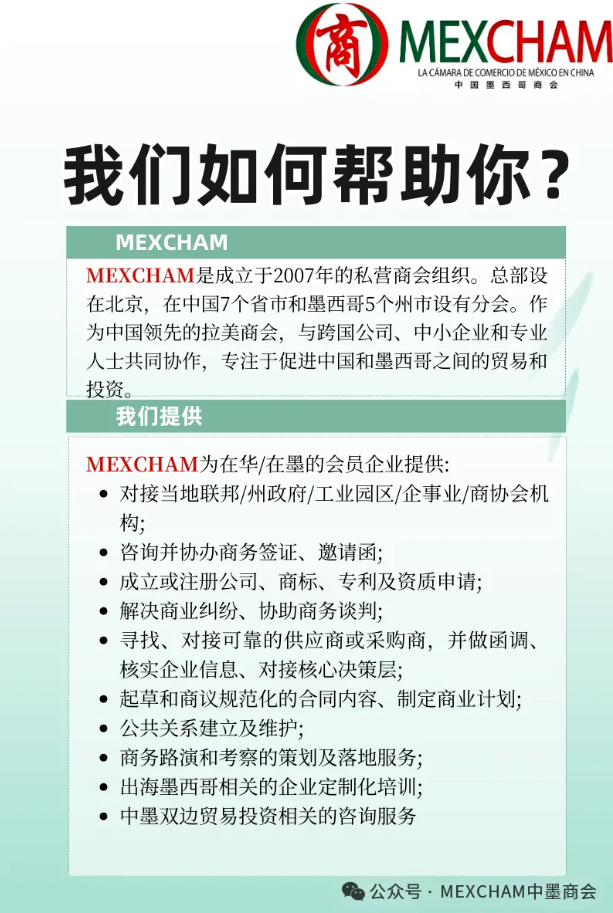

MEXCHAM continues building bridges between Mexico and China.

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

Cámara de Comercio de México en China

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org