According to data from the National Auto Parts Industry Association (INA), Mexico’s auto parts industry recorded a production value of $89.24 billion from January to September 2025. With September output reaching $10.41 billion, the strong performance effectively offset the earlier accumulated decline, narrowing the industry’s year-on-year contraction to 4.35% in the first nine months and sending a clear signal of stabilization.

INA noted that the industry’s recovery is closely linked to trends in the US automotive market. “Vehicle production in the United States fell only 1.30% year-on-year, significantly reducing the volatility that had been affecting demand,” the association stated. As the core export market for Mexican auto parts, stable US demand provided key support for Mexico’s industrial recovery.

Data further confirms Mexico’s status as the top auto parts supplier to the United States. From January to September, Mexico accounted for 43.38% of total US auto parts imports, with export shipments reaching $75.13 billion, generating a $24.26 billion trade surplus for Mexico. This underscores the deep integration of the two countries’ supply chains and highlights the US’s role as the core export destination for Mexican auto parts.

Regional production distribution continues to reflect the concentration of Mexico’s manufacturing capacity in key industrial hubs. The northern region accounted for 43.8% of national production with $39.13 billion in output, followed by the Bajio region contributing 36% ($32.16 billion). At the state level, Coahuila ranked first with $13.43 billion, followed by Guanajuato ($12.24 billion) and Nuevo Leon ($11.69 billion) — the three states form the core growth engines of Mexico’s auto parts industry.

Foreign investment in the sector showed a “quarter-on-quarter recovery” trend. From January to September, the auto parts industry attracted $1.91 billion in foreign direct investment (FDI). Although Q3 FDI declined 17.24% year-on-year, it increased 7.36% quarter-on-quarter. The United States was the largest investor with $676 million, followed by France, Germany, South Korea and Japan, reflecting sustained interest from major global automotive manufacturing countries in the Mexican market.

In terms of product structure, five major component categories dominate. Electrical components led with $17.16 billion in output (19.2%), followed by transmissions and clutches ($8.77 billion, 9.8%), fabrics, carpets and seats ($8.12 billion, 9.1%), engine parts ($7.22 billion, 8.1%), and suspension and steering systems ($6.01 billion, 6.7%). Together, these five categories account for over 52% of national production, demonstrating Mexico’s specialized advantages in core systems for modern vehicles.

Click here read the original content

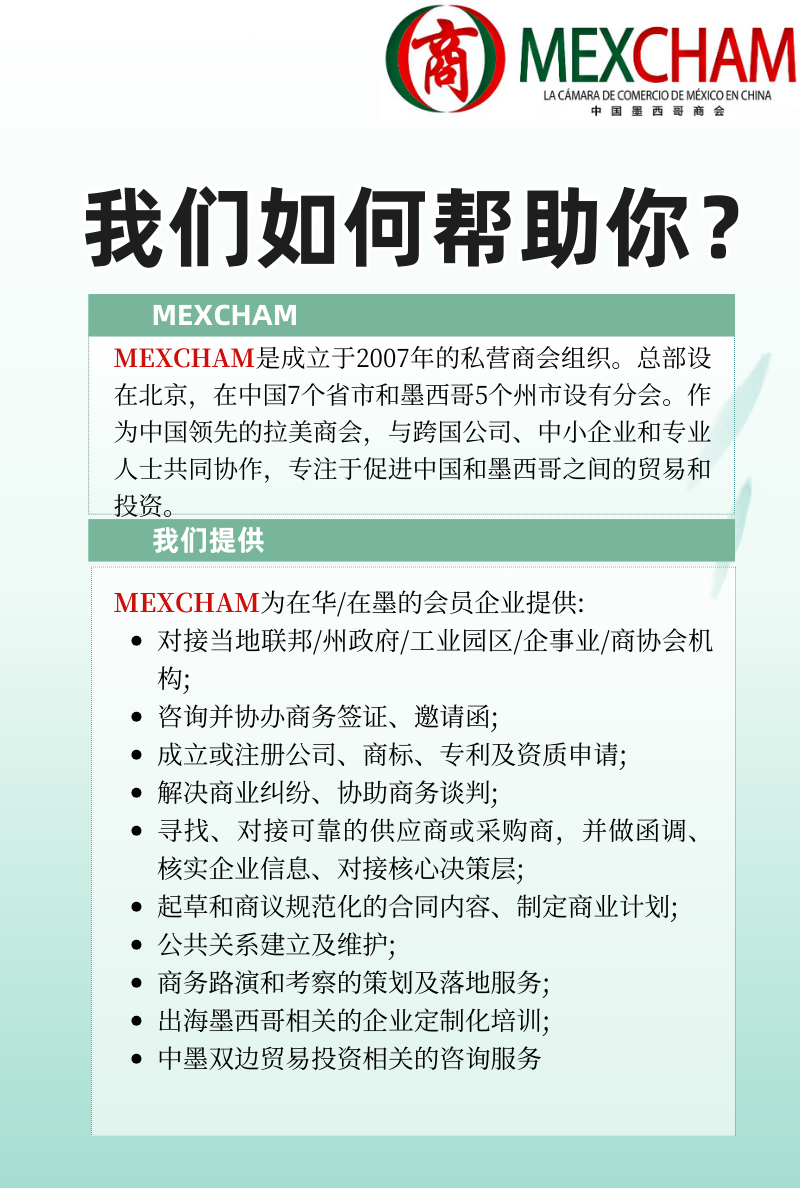

MEXCHAM continues building bridges between Mexico and China.

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

Cámara de Comercio de México en China

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org