Mexico is consolidating its position as a strategic hub for North American automotive production amid geopolitical uncertainty and ongoing supply chain challenges. The country has become a top nearshoring destination, supported by the USMCA.

However, the industry faces regulatory and trade pressures. According to INEGI, vehicle production fell 6.1% and exports decreased 0.3% in September 2025, reflecting tariff impacts and weaker US demand. “About 87% of Mexican automotive production is exported, and most of it goes to the United States,” said Julio Galván, Economic Studies Manager, INA, during the Mexico Business Summit 2025.

Mexico’s automotive sector is tightly integrated with the US market. “Every vehicle manufactured in Mexico crosses the border eight times before reaching the final consumer,” said Felipe Villarreal, CEO, Alian Plastics, highlighting the need for flexible supply chains and strategic planning.

The 2026 USMCA review is expected to tighten rules of origin and reduce reliance on Chinese components, increasing compliance demands and reshaping supply strategies. “Tariffs are pushing OEMs to replace imports with local products,” said Manuel Montoya, CEO, CLAUT. He added that sourcing raw materials from the EU or Asia is becoming costlier and more complex, making supply chain flexibility essential.

At the same time, the revised framework is expected to strengthen Mexico’s trade advantages, deepen regional integration, and prioritize North American content. “Regionalizing supply chains is complex and can take one and a half to two years. Starting now is crucial,” said Villarreal.

The sector is also embracing AI, automation, and data-driven operations. “A solid manufacturing base is needed before implementing AI or digitalization,” said Montoya. “Investments in AI must go hand in hand with investments in human talent,” added Villarreal.

Digital integration is increasing exposure to cyber risks. “For suppliers, cybersecurity investments can determine whether they remain Tier 1 partners,” said Galván.

Electrification is transforming Mexico’s industry. Domestic EV sales grew from 24,000 units in 2020 to over 124,000 in 2024, with projections exceeding 130,000 in 2025, according to Latam Mobility. OEMs are expanding EV assembly, and electronics manufacturing services are expected to grow at a 10.6% CAGR through 2030. Developing a local EV supply chain, particularly for batteries, power electronics, and storage systems, remains a priority. “EV adoption will drive the expansion of charging infrastructure,” said Montoya.

Despite challenges, Mexico maintains strong competitive advantages, including a skilled workforce, predictable costs, modern clusters, and proximity to the US market, said Odracir Barquera Salais, Director General, AMIA.

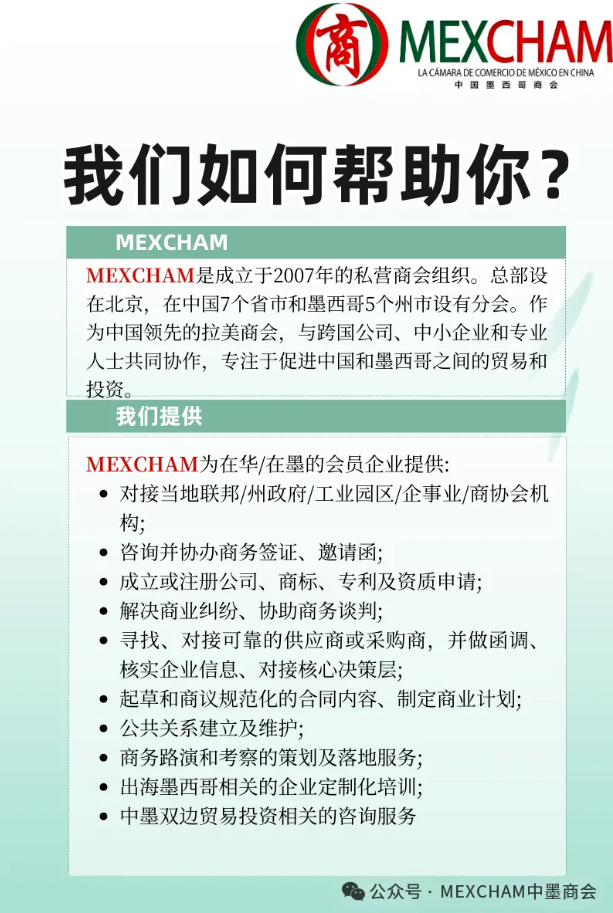

MEXCHAM continues building bridges between Mexico and China.

中国墨西哥商会将继续作为墨西哥与中国之间的桥梁,不断努力。

Cámara de Comercio de México en China

(MEXCHAM)中国墨西哥商会

www.mexcham.org

bj.info@mexcham.org